Time-proven stability!

Time-proven stability!

OUR OFFICES

Valletta Budapest Monaco Nicosia

Amsterdam

Moscow Seychelles

Time-proven stability!

Registration of Discus Holdings

1992

1998 2004 2010 20161968 1974 1980 1986

Time-proven stability!

Tax planning and financial consulting

Second citizenship and residence planning

Wide range of legal services

Fiduciary and corporate services

Trust management

Financial consulting

Consulting in the sphere of investment in real estate and works of art

OUR SERVICES

A BRIEF DESCRIPTION OF

THE HUNGARIAN ECONOMY

Time-proven stability!

2007 2008 2015

+4,1%

+12,2%

ECONOMIC GROWTH

Time-proven stability!

UNEMPLOYMENT CONSUMER PRICE

INDEX 2014-2015

0,6%

2008 2015

12%

6%

ECONOMIC GROWTH

Time-proven stability!

GROWTH OF

INTERNAL INVESTMENT

2007 2015

+5,2%

GROWTH IN

EXTERNAL INVESTMENT

2007 2015

+12,1%

INVESTMENT IN HUNGARY

Time-proven stability!

GROWTH

OF THE SERVICE SECTOR

In relation to production

+9,7%

Time-proven stability!

MECHANICAL ENGINEERING

Audi · Mercedes Suzuki Raba · VW · ·

Time-proven stability!

HUNGARY AND LOGISTICS

Transportation

of Russian and Asian oil and gas

Time-proven stability!

HUNGARY AND LOGISTICS

Transit and redistribution

of electrical energy

Time-proven stability!

HUNGARY AND LOGISTICS

Construction of many motorways

to European standards

Time-proven stability!

HUNGARY AND LOGISTICS

Construction of the largest

logistics industrial park in Eastern Europe

Time-proven stability!

HUNGARY AND LOGISTICS

Construction in Debrecen of the largest

European air terminal for receiving cargo planes

Time-proven stability!

HUNGARY AND LOGISTICS

Danube transport artery

TRUST COMPANIES

IN HUNGARY

BENEFITS OF TRUSTS FOR THE PROGRAM OF

PERMANENT RESIDENCY IN HUNGARY THROUGH INVESTMENT

IN GOVERNMENTAL BONDS

DESCRIPTION · ADVANTAGES

Time-proven stability!

15 July 2014

Time-proven stability!

Limitation of taxpayers

to avoid paying taxes by using offshore accounts

Common Reporting Standard

Time-proven stability!

Financial institutes

Tax authorities

Competent authorities

in partner-countries

Time-proven stability!

LEGISLATING TRUSTS

IN HUNGARY

March 2014

Time-proven stability!

OPENING A BANK ACCOUNT

FOR TRUST ASSETS

only

a trustee

a beneficiary

Time-proven stability!

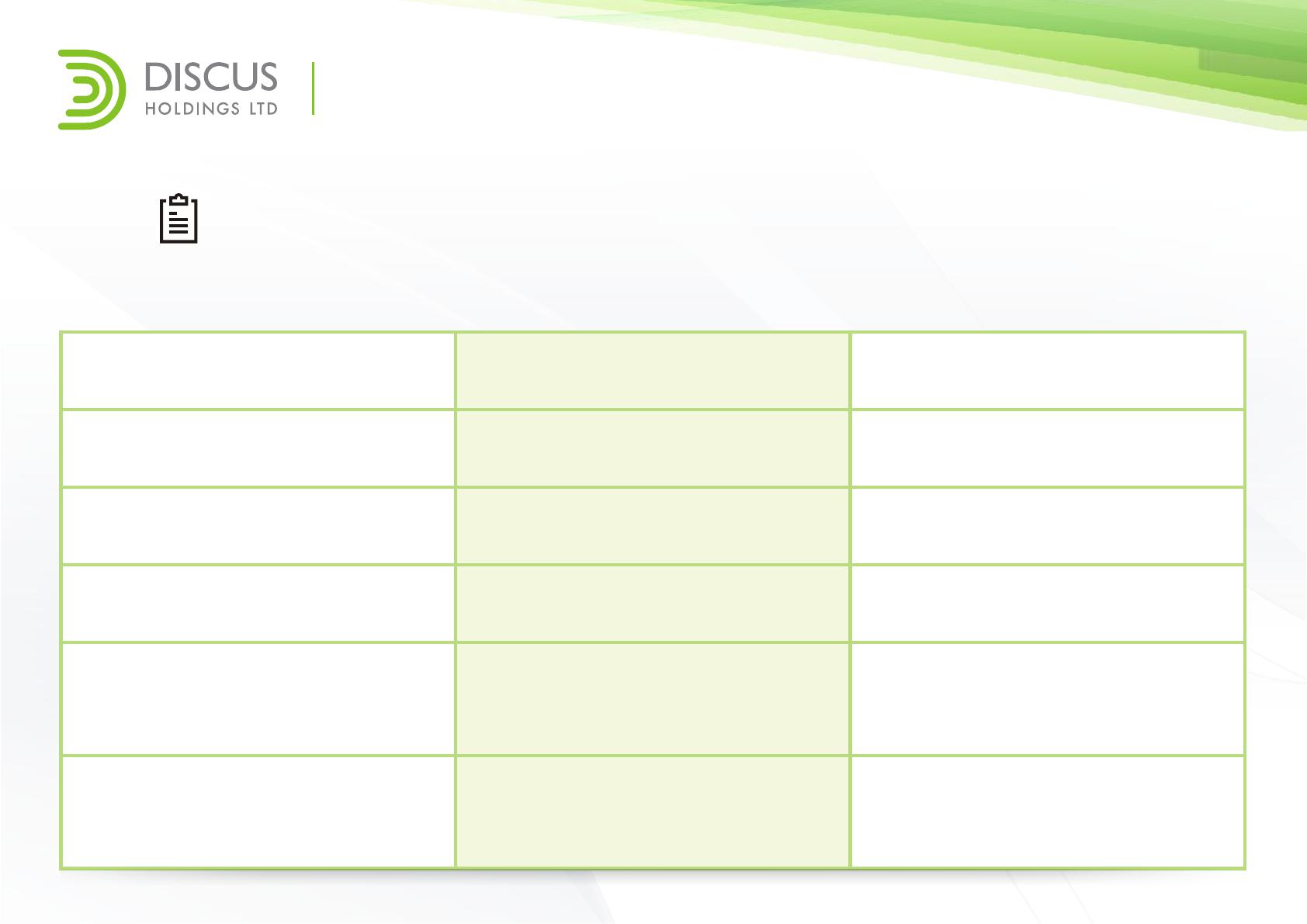

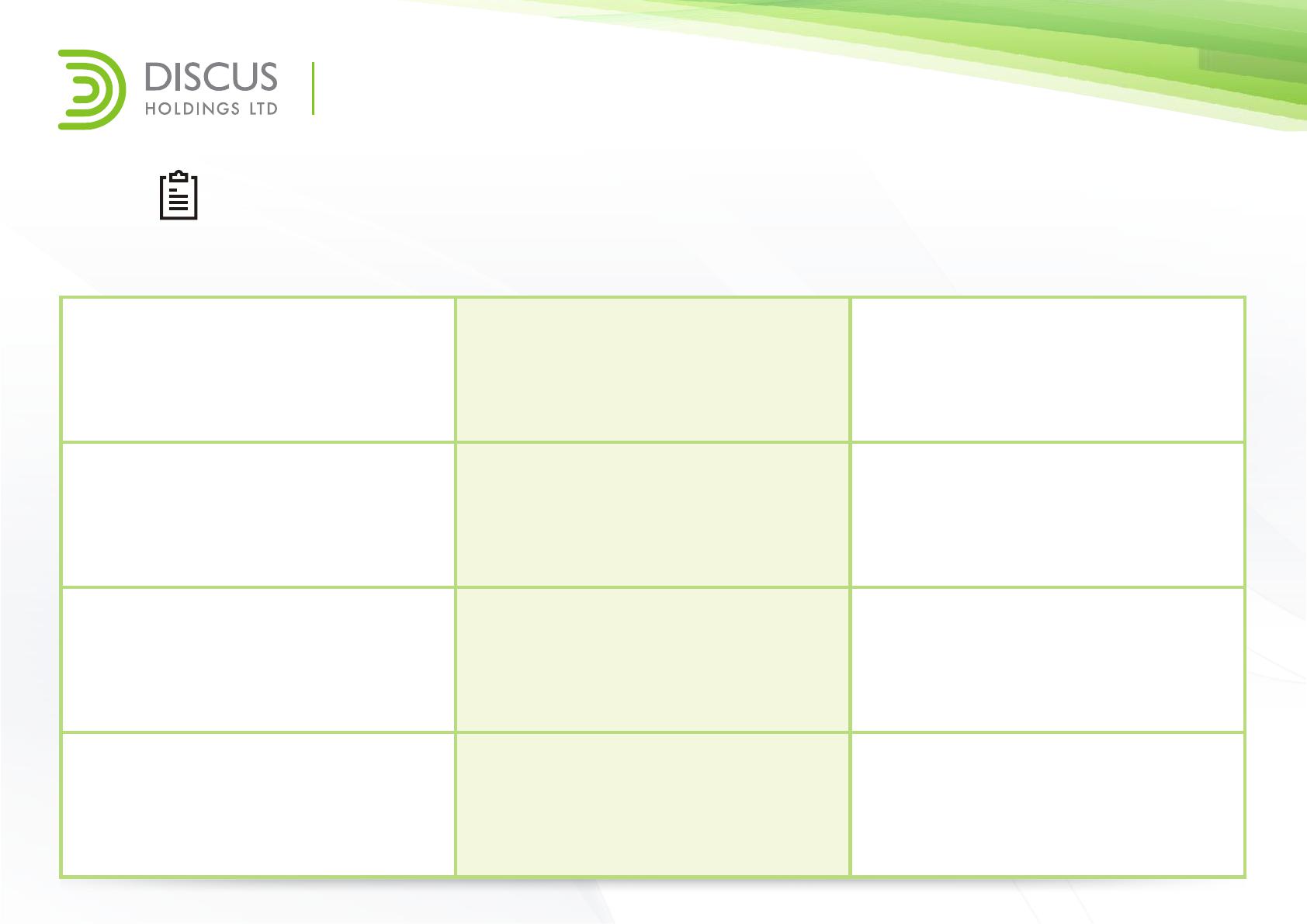

MAIN CHARACTERISTICS

OF HUNGARIAN TRUSTS

Professional licensed trust

Ad-hoc (not licensed) trust

Type of trust

Who can be a settlor

(entrusted administrator)

Testamentary - Inter Vivos;

Discretionary – Non-

Discretionary; Private-Charity

Anyone

(legal or private person;

resident or non resident)

Testamentary - Inter Vivos;

Discretionary – Non-

Discretionary; Private-Charity

Anyone

(legal or private person;

resident or non resident)

Time-proven stability!

Limitation in the number

of trustees

Who can be a beneficiary

Number of trustees

(minimum)

Co-trustee

No

One

Yes

Case / Year

One

Yes

MAIN CHARACTERISTICS OF HUNGARIAN TRUSTS

Professional licensed trust

Ad-hoc (not licensed) trust

Anyone

(legal or private person;

resident or non resident)

Anyone

(legal or private person;

resident or non resident)

Time-proven stability!

Trustee's citizenship /

registration form

Registration of trust

Corporate trustee

Guarantee of

professional liability

A private limited company in the

EEA can be a professional

trustee

No

Only a corporate trustee can

have a professional license

Yes, up to 5 million Euros

Yes, in the Hungarian

National Bank

No requirement

No

Professional licensed trust

Ad-hoc (not licensed) trust

MAIN CHARACTERISTICS OF HUNGARIAN TRUSTS

Anyone

(legal or private person;

resident or non resident)

Time-proven stability!

Asset type

Distribution of assets

Time limit

Protector

Yes

Any

(cash, portfolio investment,

material and non-material

assets, rights and claims)

50 years

Can use

Hungary

No

Registration address

Publicly available information

MAIN CHARACTERISTICS OF HUNGARIAN TRUSTS

Any

(cash, portfolio investment,

material and non-material

assets, rights and claims)

Yes

50 years

Can use

Hungary

No

Time-proven stability!

Yearly tax report

Bookkeeping

Audit

Yes

HUF / EUR

No

No

VAT

Taxation

Taxation of moving assets

from Settlor to trust

> 500 million HUF – 10%

< 500 million HUF - 19%

TAX Free,

no hidden taxes

Professional licensed trust

Ad-hoc (not licensed) trust

MAIN CHARACTERISTICS OF HUNGARIAN TRUSTS

Yes

HUF / EUR

No

No

> 500 million HUF – 10%

< 500 million HUF - 19%

TAX Free,

no hidden taxes

Time-proven stability!

Taxation of distribution of

assets from a trust to a

private individuals

Taxation of distribution of

a trust's profit to a private

individuals

Taxation of distribution of

assets from a trust to a

legal entity

Taxation of distribution of

a trust's profit to a legal

entity

HU residence – TAX Free

Non-resident – taxation of

beneficiary

WHT not applicable

HU residence –15%

Non-resident – taxation of

beneficiary

WHT not applicable

HU resid. > 500 million HUF – 10%

< 500 million HUF - 19%

Non-resident – taxation of

beneficiary, WHT not applicable

HU residence – TAX Free

Non-resident – taxation of

beneficiary

WHT not applicable

Professional licensed trust

Ad-hoc (not licensed) trust

MAIN CHARACTERISTICS OF HUNGARIAN TRUSTS

HU residence – TAX Free

Non-resident – taxation of

beneficiary

WHT not applicable

HU residence –15%

Non-resident – taxation of

beneficiary

WHT not applicable

HU resid. > 500 million HUF – 10%

< 500 million HUF - 19%

Non-resident – taxation of

beneficiary, WHT not applicable

HU residence – TAX Free

Non-resident – taxation of

beneficiary

WHT not applicable

Time-proven stability!

ADVANTAGES

OF THE HUNGARIAN TAX SYSTEM

Receive dividends – tax free

Inheritance – tax free

Estrangement of limited participation – tax free

Royalty - > 500 million HUF – 5%; < 500 million HUF – 9.5%

R&D – 10-15% from CIT

No WHT when paying dividends, royalties and interest

to a non-resident address

0% when there are debt obligations that exceed CIT

three times

Time-proven stability!

PRIMUS TRUST

FIRST HUNGARIAN

LICENSED

PROFESSIONAL TRUST

Time-proven stability!

UNIVERSALITY

OF A HUNGARIAN TRUST

Independent

licensed

depository

An alternative

solution to outdated

offshore schemes

Tool

of asset

declaration

PERMANENT RESIDENCY

IN HUNGARY

through

INVESTMENT IN GOVERNMENT BONDS

HUNGARIAN PERMANENT

RESIDENCE PROGRAM

December 2012

February 2013

March 2013

Accepted by Parliament

Signed by the Minister

of National Economy

Came into force

Time-proven stability!

HOLDERS OF PERMANENT RESIDENCY

IN HUNGARY THROUGH INVESTMENT

IN GOVERNMENT BONDS

DO NOT HAVE THE RIGHT TO:

vote

be elected

take leadership roles

in government

institutions

1 2 3

Time-proven stability!

HOLDERS OF PERMANENT RESIDENCY

IN HUNGARY THROUGH INVESTMENT

IN GOVERNMENT BONDS

HAVE THE RIGHT TO:

live

medical services

work

entrepreneurial activity

tax concessions

study

social security

social benefits

Time-proven stability!

POSSIBLE APPLICANTS

FOR HUNGARIAN RESIDENCY

Main

applicant

Spouse Children

(who are still

minors)

Parents

(who fit the

'pensioner'

criteria)

Time-proven stability!

PERMANENT RESIDENCY IN HUNGARY

Freedom of movement throughout the Schengen Areas countries

No need to invest in real estate

No requirement to live there

Time-proven stability!

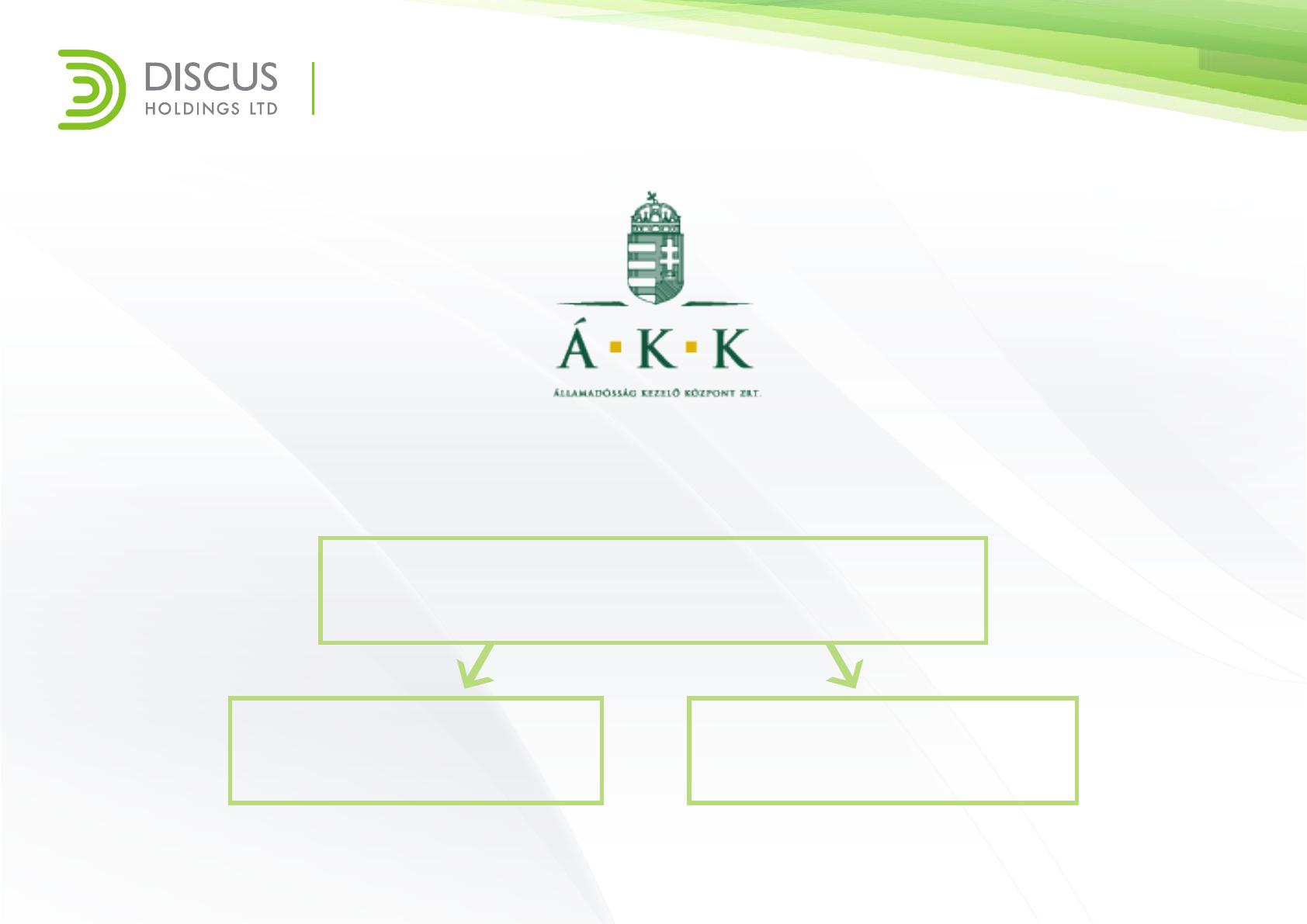

MANAGEMENT OF THE STATE ECONOMY

Magyar Államadósság Kezelõ Zrt.

Control and management

of the program

Issue of registered

residential bonds

Time-proven stability!

ADVANTAGES OF THE PERMANENT

RESIDENCY IN HUNGARY

No requirement

to live there

Freedom of movement

throughout the Schengen

Area countries

Relatively low

minimum amount

of investment needed

Time-proven stability!

5000+ 250+ ˆ1.5bn

New residents of Hungary

due to the investment

residency program

Applications for receiving

residency in Hungary

through investment

in government bonds

Amount of attracted

investment since

the start of the program

Time-proven stability!

HUNGARIAN INVESTMENT

RESIDENCY PROGRAM

ATTRACTS SECURE INVESTORS

and becomes a platform for the development

of business, by citizens of Third Countries

in the territory of the EU

Time-proven stability!

HUNGARIAN INVESTMENT

RESIDENCY PROGRAM

It does not pose a danger to the security of Hungary and the EU

It does not pose a danger to the work market in Hungary and the EU

WHY EXACTLY SHOULD YOU CHOOSE

PERMANENT RESIDENCY IN HUNGARY THROUGH

INVESTMENT IN GOVERNMENTAL BONDS?

Time-proven stability!

RESIDENCY BONDS:

Registered government bonds

of special appointment

Nominal cost (ˆ300,000)

5 year maturity period

Time-proven stability!

SIGNING

THE CONTRACT

SUBMITTING

DOCUMENTS

PROCEDURE FOR BUYING THE BONDS AND

APPLYING FOR PERMANENT RESIDENCY

Time-proven stability!

Passport

Birth certificate

Marriage certificate

Completed Questionnaire

Application form

REQUIRED DOCUMENTS

Time-proven stability!

PLACE OF APPLICATION

Diplomatic

representation

in Hungary

Office

of Immigration

and Citizenship

Time-proven stability!

PROCEDURE FOR BUYING THE BONDS AND

APPLYING FOR PERMANENT RESIDENCY

Sign the contract

Receive payment instructions for conducting investments and for the

administrative fees

Make the payments

Prepare the Investor's file for submission for a Hungarian residence permit

Submit application for residence permit

Await a decision from the Hungarian Office of immigration and citizenship

Wait for the Hungarian state security services to check the character

of the Investor

Issue residency card

Receive residency card

1.

2.

3.

4.

5.

6.

7.

8.

9.

Time-proven stability!

TIME NEEDED FOR APPLICATION

Through diplomatic

representation – up to 45 days

Through the Office of immigration and

citizenship in Budapest – up to 8 days

Time-proven stability!

TURN A RESIDENCE PERMIT

INTO PERMANENT RESIDENCY

Filing a petition – 6 months after the issue date

of the residency card

Within 90 days from the moment of petition filing

Receive residency card with permanent residency status

Time-proven stability!

ARRANGEMENTS FOR APPLICATION

Possibility to apply for permanent residency

immediately for the whole family

Possibility to apply for permanent residency

for every family member using separate applications

Application for permanent residency for all children

who are minors is possibly only through a separate

investor package

Time-proven stability!

RETURN OF INVESTMENT

File a formal request for the return

of the investment after 5 years

Investment returned within 90 days

Time-proven stability!

Bank commission - ˆ145,000

Administrative costs - ˆ5,000

PERMANENT RESIDENCY IN HUNGARY - ˆ150,000

FINANCING OF INVESTMENTS

Time-proven stability!

PERMANENT RESIDENCY IN HUNGARY IS:

the right

to work

the right to

entrepreneurial

activity

the right

to study

social rights

freedom to move

throughout

and live in the

Schengen Area

countries

Time-proven stability!

Investors Spouses Children Parents

PERMANENT RESIDENCY IN HUNGARY –

IT'S PERMANENT RESIDENCY FOR

Time-proven stability!

RELIABLE

DISCRETE

LEGAL

CONVENIENT

FAST

PERMANENT

RESIDENCY

IN HUNGARY is

Time-proven stability!

Time-proven stability!

Phone (Russian): + 356 2778-0492

Phone (English): + 356-2122-3258

Fax: + 356-2122-3058

info@discusholdings.com.mt

www.discusholdings.com.mt

158, Merchants Street,

Valletta, VLT 1176, Malta